arkansas estate tax statute

B 1 notwithstanding subsection a of this section if the amount of taxable income or taxable estate for a taxpayer for a year as returned to the united states department of the treasury is changed and corrected by the commissioner of internal revenue or an officer of the united states of competent authority the taxpayer within one. If the estate exceeds the 1206 million exemption bar the Federal Estate Tax that can reach up to 40 may significantly reduce your inheritance.

/cloudfront-us-east-1.images.arcpublishing.com/gray/6CKNREVXUVEMBOV7PAODKCHCBQ.PNG)

These New Arkansas Tax Laws Are Effective Jan 1 2022

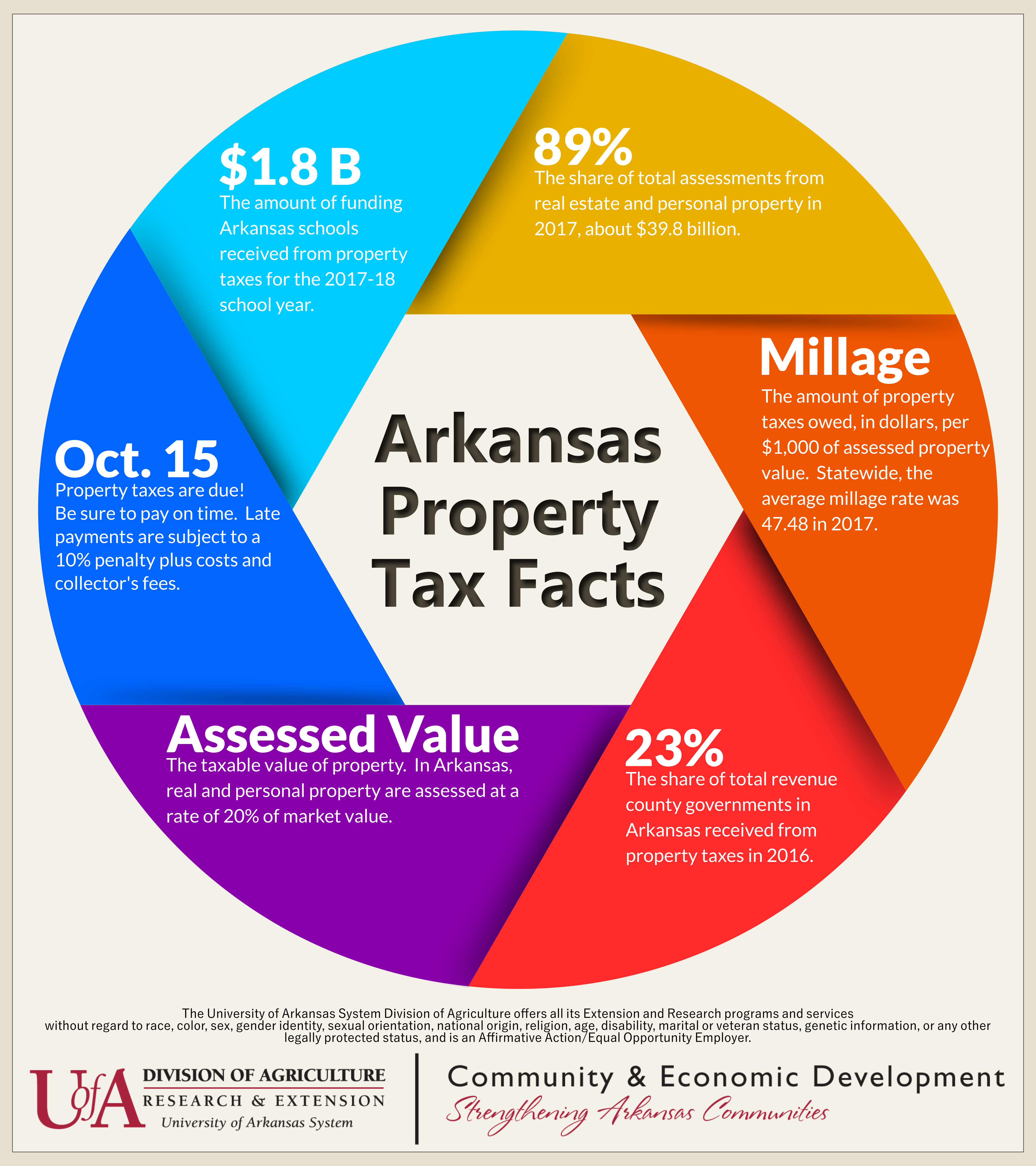

Be sure to pay before then to avoid late penalties.

. All Major Categories Covered. As far as gift taxes go Arkansas also does not have a state gift tax. Because Arkansas taxes based on 20 percent of assessed value 25 mills is essentially equivalent to 05 percent of propertys value.

The Estate Tax is a federal law imposed on the estate of a deceased. While there arent any specific amounts or percentages for the fees they do have limits. At the federal level the federal gift tax makes an exclusion of 15000 per year per gift recipient.

AR4FID Fiduciary Interest and. Fiduciary and Estate Income Tax Forms 2022. Use DoNotPays Straightforward Guide to Property Tax Exemptions and Appeals.

A 1 All taxes levied on real estate and personal property for the county courts of this state when assembled for the purpose of levying taxes are due and payable at the county collectors office between the first business day of March and October 15 inclusive. A disabled person A person aged 65 or older This freeze can be waived in case of substantial improvements to your homestead. If there are any creditors such as mortgages credit card bills or hospital.

Want to avoid paying a 10 late penalty. According to law they cannot be more than 10 percent on the first 1000 value of the estate and five percent on the next 4000 and three percent of the remaining amount. While household property is exempted from assessment the statute clearly states that it cannot be used for income producing purposes.

When a property owner fails to timely pay the assessed tax the property may become subject to sale by the State. If you gift more than that amount to someone you must report it to. Sign up for Gov2Go to get personalized reminders when its time to assess pay property taxes and renew your car tags.

Arkansas Lease and Rental Agreement Laws Basics of Arkansas statutes governing the legal relationship between landlords and tenants including maximum security deposit allowed by law time limits for returning deposits and anti-discrimination. If a person provides written grounds for contest to the court the will goes through the probate process. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc.

Property Taxes and Property Tax Rates Property Tax Rates Each Arkansas city and county collect property taxes and the tax is charged at 20 of the. AR1002ES Fiduciary Estimated Tax Vouchers for 2022. People who own real estate in Arkansas are required to pay property taxes every year to the county government where the property is located.

Arkansas charges a state sales tax rate of 65. Amendment 79Arkansas Property Tax Exemption for Seniors Amendment 79 freezes the assessed value of a homestead property whose owner is. The amount of taxes due annually is based on the assessed value of the property.

2 All taxes unpaid after October 15 are delinquent. In Arkansas the probate process is mandatory for any contested estate if there are creditors including a mortgage and for any estate larger than 100000. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Select Popular Legal Forms Packages of Any Category. An executor can charge a reasonable fee for managing an estate in Arkansas. I 1 A An amended return or verified claim for credit or refund of an overpayment of any state tax shall be filed by the taxpayer within three 3 years from the time the return was filed or two 2 years from the time the tax was paid whichever of the periods expires later.

Sales and Use Tax Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws. Any property used for the production of income should be assessed as commercial personal property using the appropriate form. This includes Sales Use Aviation Sales and Use Mixed Drink Liquor Excise Tourism Short Term Rental Vehicle Short Term Rental Residential Moving Beer Excise and City and County Local Option Sales and Use Taxes.

This means that you may gift up to 15000 per person per year without worrying about tax consequences. Specifically Amendment 74 to the Arkansas Constitution narrowly approved by voters in 1996 requires all school districts to set a minimum 25 mills property tax. Online payments are available for most counties.

Justia US Law US Codes and Statutes Arkansas Code 2019 Arkansas Code Title 28 - Wills Estates and Fiduciary Relationships There is a newer version of this Title 2020. Pay-by-Phone IVR 1-866-257-2055 The statewide property tax deadline is October 15.

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

The Ultimate Guide To Arkansas Real Estate Taxes

Governor Delays Call For Session On Tax Cut Plan

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Tax Rates Rankings Arkansas State Taxes Tax Foundation

Arkansas State 2022 Taxes Forbes Advisor

Filing An Arkansas State Tax Return Things To Know Credit Karma

Learn More About Arkansas Property Taxes H R Block

10 New Laws To Know About In 2022

Tax Deed Properties In Arkansas The Hardin Law Firm Plc

Homestead Tax Credit Real Property Aacd

Understanding Your Arkansas Property Tax Bill

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Inheritance Laws What You Should Know